How Would You Like To Be Remembered?

The term “planned giving” refers to charitable gifts that require some planning before they are made.

The Planned Giving Program offers you the opportunity to create a lasting impact on the Lifehouse mission. By including Lifehouse in your estate plans, such as a bequest in your will or trust, naming us as a beneficiary of a retirement plan, or establishing a charitable gift annuity, you help ensure our work continues for generations to come.

Planned gifts can be structured to meet your financial and philanthropic goals, often providing tax advantages or income benefits to you or your loved ones.

Our Mission

To improve the quality of life for people with developmental disabilities in our community by providing a lifetime of compassionate support in an atmosphere of respect, inspiration, and purpose.

James Ricks, Lifehouse Parent and Board Member, shares how he decided to become a member of the Lifehouse Legacy Society.

Webinar: The Power of Planned Giving

Join us for this special, informative session!

October 30, 2025

Register below, and a link and further details will be provided for the webinar.

We will Explore :

The importance of estate planning

How a planned gift can make a meaningful impact on Lifehouse’s future

The various options and benefits available to donors

What is Planned Giving?

The term “planned giving” refers to charitable gifts that require some planning before they are made.

The Lifehouse Planned Giving Program offers you the opportunity to create a lasting impact on our mission. By including Lifehouse in your estate plans, such as a bequest in your will or trust, naming us as a beneficiary of a retirement plan, or establishing a charitable gift annuity, you help ensure our work continues for generations to come.

Planned gifts can be structured to meet your financial and philanthropic goals, often providing tax advantages or income benefits to you or your loved ones

The Legacy Society

Donors who notify us that they have included Lifehouse in their estate plans are recognized as members of our Legacy Society. This special group of supporters shares a profound commitment to our future.

As a Legacy Society member, you will receive quarterly updates from the CEO, and special recognition in our Annual Report. The satisfaction of knowing your legacy will help sustain and grow our mission. Membership in the Legacy Society is our way of expressing gratitude to those who have made the extraordinary decision to include our organization in their lasting plans.

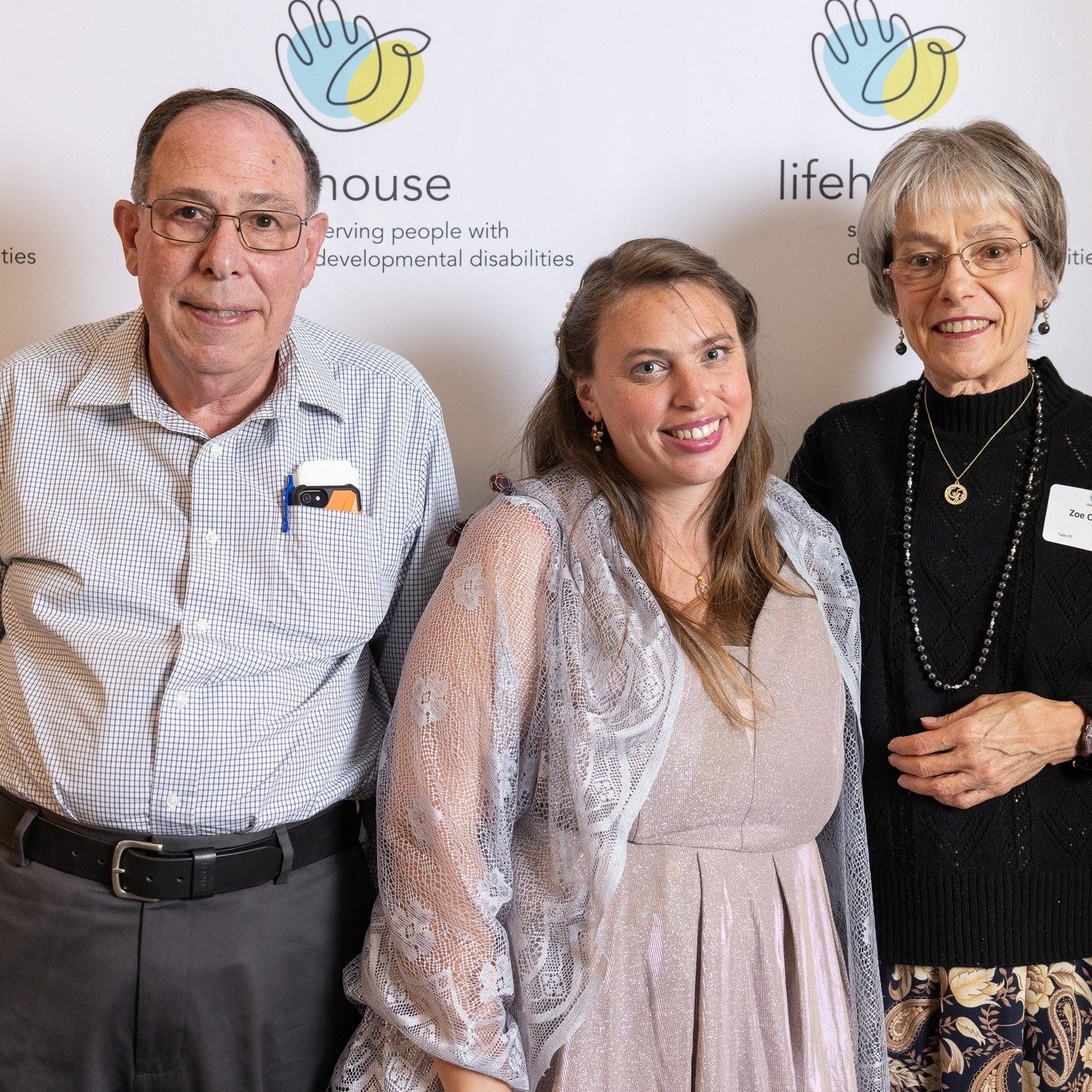

“Lifehouse has been there for our daughter Meredith since she was a child. Now at 56, she continues to thrive with the care, respect, and love that Lifehouse provides every single day. Including Lifehouse in our will was the most natural decision. We know that when we’re gone, Meredith will still be surrounded by the security and community she deserves.” — Mary Lloyd, Mother of Meredith

Through Planned Giving, you create a legacy of inspiration and opportunity. Our 'Full Life' profiles highlight the incredible stories of resilience and achievement made possible by the generosity of donors like you.

Mary & Meredith at the Lifehouse Picnic in 1993.

How to join

If you have already included us in your will or other estate plans, please let us know so we can welcome you into the Legacy Society.

If you are considering a planned gift, we would be honored to work with you and your financial advisors to find the option that best fits your wishes.

Thank you for your continued support of Lifehouse and the individuals under our care.

You are an important part of our community, and your generosity significantly improves the quality of life for people with I/DD.

Choose the Right Option

There are several ways you can make a planned gift to Lifehouse:

1. Bequests: You may bequeath cash, securities, real estate, or other assets to Lifehouse in your will or trust. You decide how - whether it's a certain amount, a percentage, or the residue of your estate after other bequests.

2. Life Insurance: You can name Lifehouse as the beneficiary of your life insurance policy or transfer the ownership of a paid-up policy to Lifehouse.

3. Retirement Assets: You can gift your retirement assets such as an IRA, 401(k), or 403(b) by naming Lifehouse as a beneficiary.

4. Gifts of cash and/or other assets with income reserved for the life of the donor and /or another beneficiary. These types of gifts can take the following forms:

Charitable gift annuity: You can place cash or property into a trust that will provide an income for you (or another named individual) for life, with the remainder of the trust going to Lifehouse at the end of the trust term

Deferred charitable gift annuity: Allows you to make a gift to Lifehouse while receiving a fixed income stream later, typically at retirement or another designated time

Charitable remainder trust: You can set up an irrevocable trust that allows you to donate assets to Lifehouse while receiving income for life or a specified period. The remaining assets are then donated to Lifehouse upon the death of the beneficiary or the end of the trust term

Pooled income fund agreement: You can contribute to a charitable trust that allows donors to pool their assets and receive income for life while benefiting Lifehouse with a remainder interest

We strongly recommend you consult with your financial advisor or attorney to understand the potential benefits so that you can choose the options that reflect your values and estate planning needs. Lifehouse does not provide legal or tax advice.